So, the allowance for doubtful accounts helps you to understand how much amount you need to collect from your debtors. In other words, the credit balance in the allowance for doubtful accounts tells you the amount that is to be collected from your credit customers. Use a documented process to monitor accounts receivable, and to increase cash collections, so you can operate your business with confidence.

Apply for Accounts Receivables Administrator

- Calculating your business’s accounts receivable turnover ratio is one of the best ways to keep track of late payments and make sure they aren’t getting out of hand.

- When it’s clear that an account receivable won’t get paid, we have to write it off as a bad debt expense.

- A loan is impaired when, based on current information and events, it is probable that a creditor will be unable to collect all amounts due according to the contractual terms of the loan agreement.

- In a similar—albeit exact opposite—way, firms increase accounts receivable when revenue is earned before cash is received.

- The term remote is used here, consistent with its use in Topic 450, to mean that the likelihood is slight that a loan commitment will be exercised before its expiration.

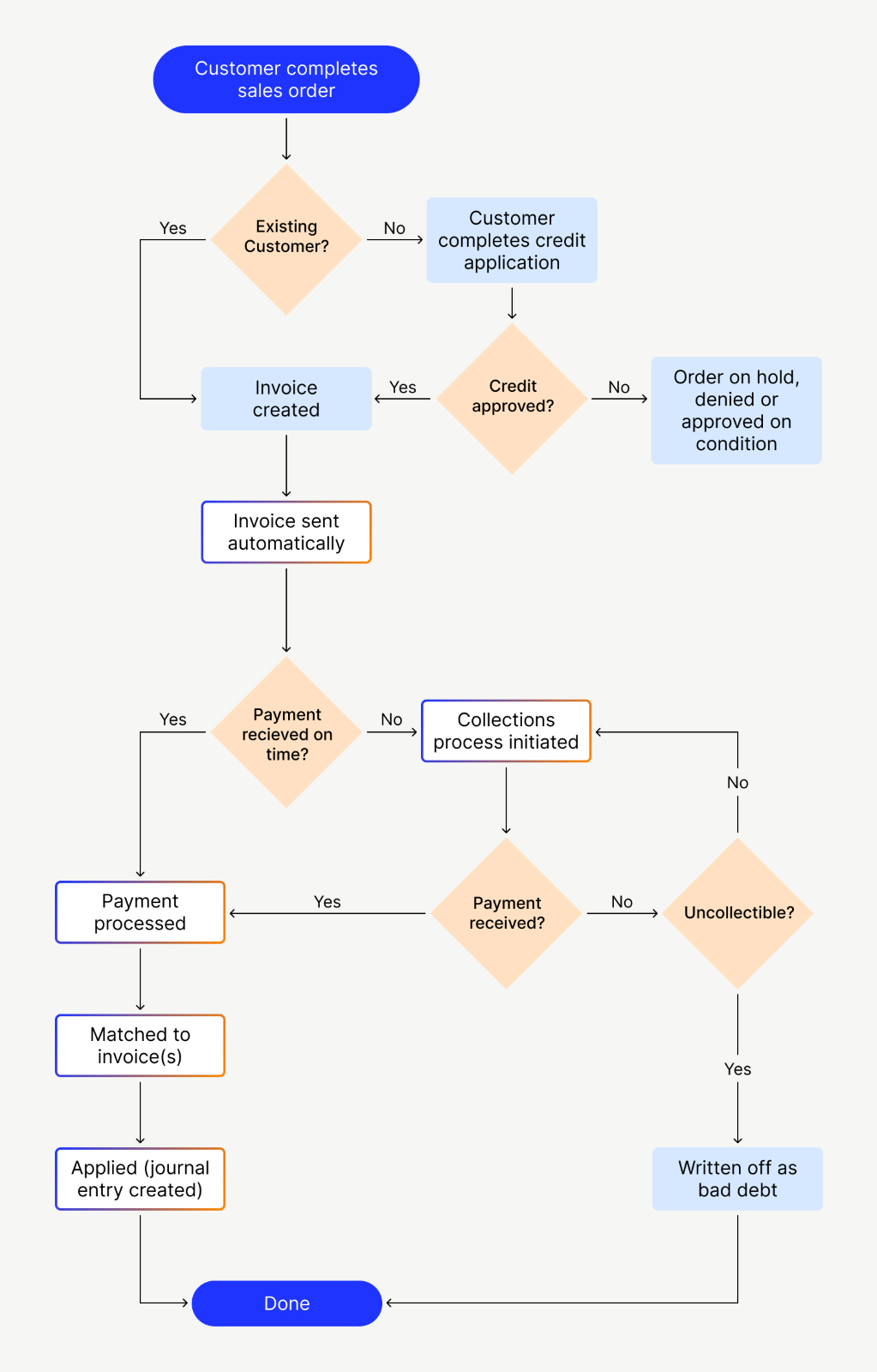

You should monitor this report and implement a collections process to email and possibly call clients to ask for payment. To recognise an expense before cash is paid, businesses increase the accounts payable balance. In a similar—albeit exact opposite—way, firms increase accounts receivable when revenue is earned before cash is received. Plus, it explains where the balance is posted in the financial statements. You’ll read about accounts receivable turnover, the ageing schedule, and how to increase cash flow.

What is the “allowance for uncollectible accounts” account?

From that point onward, the delivery is technically the responsibility of either a third-party shipper or the buyer. Accordingly, net realizable value of accounts receivable is a measure of valuing the accounts receivables of your business. According to the above example, a customer on an average takes 65 days to pay for the goods purchased on credit for Ace Paper Mills. Likewise, crediting the sales account by $200,000 means an increase in sales by the same amount. Let’s consider the above example again to understand what is accounts receivable and the journal entry for accounts receivable.

Risk of Bad Debts

Accounts receivable are the amount the company expects to receive in the future, but sometimes not all balances are collectible. Hence, the company might need to estimate the uncollectable amount which is called “allowance for doubtful accounts”. This journal entry is made to eliminate (or reduce) the receivables that the company has previously recorded in its account. Receivables represent an extended line of credit from a company to client that require payments due in a relatively short time period, ranging from a few days to a fiscal year. Set up a system of late payment reminders on a set schedule—for example, reminders for 1 week, 2 weeks, and 3 weeks past due. It’s best to send a gentle reminder for the earliest contact and then include more formal documentation if the customer continues to ignore payment.

Where and what is accounts receivable on a balance sheet?

For example, the company ABC has accounts receivable from 4 customers in which 3 of the customers has overdue their payment for some days already. Automating aspects like invoice generation, payment processing, and late payment reminders makes it easy to maintain a prompt and consistent AR process. This improves the likelihood of payment and enhances the customer experience. There are a variety of commonly accepted payments for small businesses, including e-transfer, ACH, credit, debit, check, and online payments.

Accounts Receivable Turnover (in Times)

Meanwhile, the supplier would have $1,000 in accounts receivable on their balance sheet. Finally, to record the cash payment, you’d debit your “cash” account by $500, and credit “accounts receivable—Keith’s Furniture Inc.” by $500 again to close it out once and for all. Offering them a discount for paying their invoices early—2% off if you pay within 15 days, for example—can get you paid faster and decrease your customer’s costs. the 5 best accounting software for small business of 2021 If you don’t already charge a late fee for past due payments, it may be time to consider adding one. If a company offers customers a discount if they pay early and they take advantage of the offer, then they will pay an amount less than the invoice total. The accountant needs to eliminate this residual balance by charging it to the sales discounts account, which will appear in the income statement as a profit reduction.

For many retail firms, accounts receivable represents a substantial portion of their current assets. To finish off the accounts receivable business processes, you need to record accounts receivable in your books. Depending on your business’s preferences, you can either send a paper or an electronic invoice.

Furthermore, accounts receivable are classified as current assets, because the account balance is expected from the debtor in one year or less. Other current assets on a company’s books might include cash and cash equivalents, inventory, and readily marketable securities. Now, until the time when Ace Paper Mill receives the payment of $200,000, it will record $200,000 as Accounts Receivable in its books of accounts. Thus, both accounts receivable and sales account would increase by $200,000. This means the bad debts expense account gets debited and the allowance for doubtful accounts gets credited whenever you provide for bad debts.

If you can’t contact your customer and are convinced you’ve done everything you can to collect, you can hire someone else to do it for you. Though lenders and investors consider both of these metrics when assessing the financial health of your business, they’re not the same.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Accounts receivable represent funds owed to a company and are booked as an asset. Accounts payable, on the other hand, represent funds that a company owes to others and are booked as liabilities. Scarlet Systems, Inc. (SS) developed an ERP software for Johnson Tools, LLC (JT) for $200,000 due within 30 days of successful testing of the system.